How does customs clearance work?

To simplify customs clearance for you, we optionally take care of all import and export customs formalities when you book transports via our platform.

- When is customs clearance necessary?

- What is a customs inspection?

- Which Incoterm does Cargoboard offer?

We are also happy to support you with shipments to and from Switzerland and the United Kingdom (UK). Our goal is to make customs clearance as time-saving and simple as possible and to ship your goods as cheaply and quickly as possible.

If you want to export goods outside the EU, different regulations apply depending on the country of origin and destination. Cargoboard will gladly take care of export declarations for export customs clearance and import declarations for import customs clearance.

After completing a booking with customs clearance, you will receive an email regarding the customs power of attorney (POA) so that we can take over further communication with customs on your behalf.

Important: We can only schedule the pickup of the goods once we have received all necessary information and documents and the deadline for presentation/customs inspection has passed. This may result in deviations from the scheduled pickup date.

When is customs clearance necessary?

In principle, customs clearance is necessary if you want to ship your goods outside the European Union. However, customs clearance is not necessary for all shipments outside the European Union.

If the invoice value of your shipment is 1.000 € or more and/or the weight of a shipment is 1.000 kg or more, you need an export declaration and a commercial invoice. If your shipment is worth less than 1.000 € and weighs less than 1.000 kg, a commercial invoice is sufficient.

Exception Great Britain: An export declaration is required for all shipments in and out of the UK.

Exception Poland: For all shipments from Poland to non-EU countries, an export declaration is always required.

What documents do I need for customs clearance?

In order to provide you with the best possible support in customs clearance, you will need a few documents.

- Commercial invoice

After the booking process, we will send you a template for a customs-compliant commercial invoice. Including:

-

- Address of the exporter as well as seller (if different), buyer and consignee (if different).

- Description of goods with customs tariff number

- Number of packages (cartons, pallets etc.)

- Weight specification

- Delivery terms DAP

- Country of origin of the goods

- Export declaration

We also take care of the export declaration for you. We require the following information:

-

- Packing list (net/gross weight & number of packages)

- EORI number

What is an EORI number?

The EORI number confronts questions for many of our customers. In principle, it can be said that all companies that want to import into the EU or export from the EU need an EORI number. You can also book your import or export with Cargoboard without an EORI number. To do so, apply for the EORI number at customs and simply attach your application for the provision of an EORI number to the end of your booking.

You can apply for an EORI number here.

What is a customs inspection?

In the case of a customs inspection, dutiable shipments are reported to the responsible customs authority. Customs have the option of inspecting the goods as a result of a customs inspection or releasing the goods after reviewing the export documents.

It is particularly important for you to specify the correct pickup location. The pickup address serves customs as the location for a possible customs inspection.

After the export declaration, customs has 24 - 48 hours to check your shipments. Only then the departure of your goods can take place.

Important: A customs inspection is a normal procedure in customs clearance and no reason for fear or concern. Most of the time, a customs inspection takes place because of a random check.

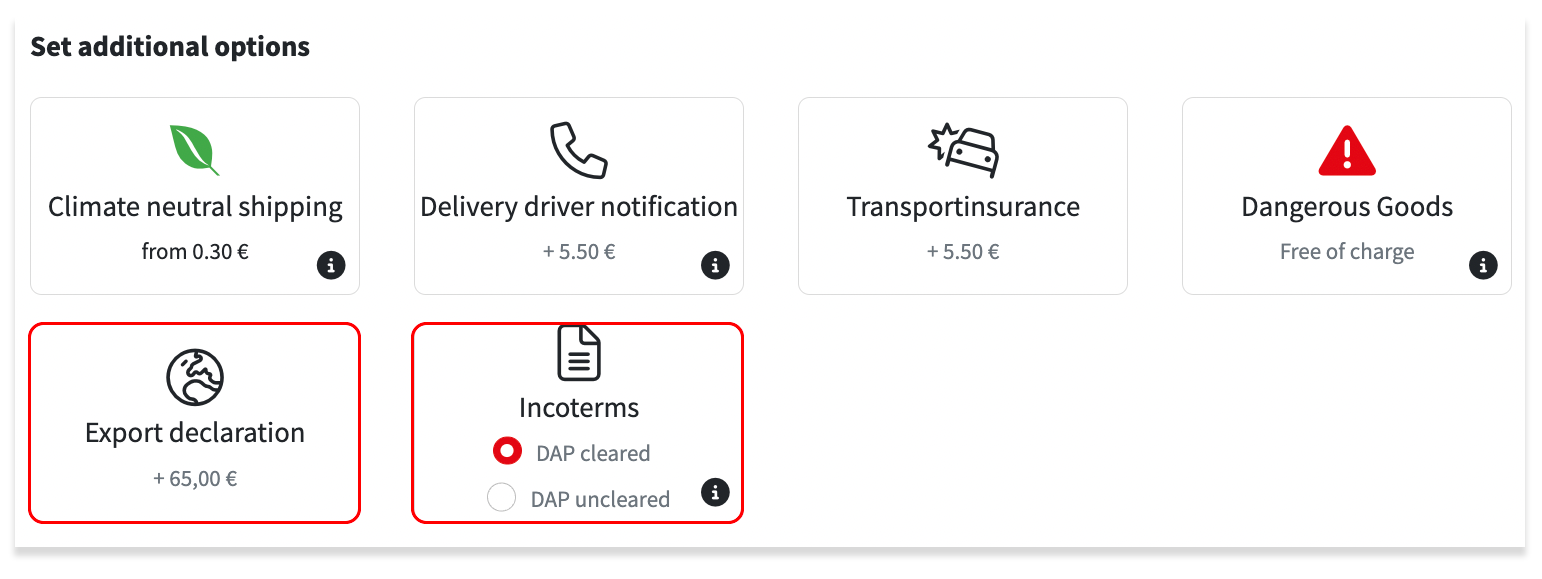

Which Incoterm does Cargoboard offer?

Cargoboard offers you the Incoterm DAP. Incoterms stands for International Commercial Terms. These clauses comprise a set of predefined international rules published by the International Chamber of Commerce that define contract terms for international commercial contracts.

What does DAP - Delivered At Place mean?

With DAP, the seller bears the costs and risks of transporting the goods to an agreed address. As soon as the goods arrive and are released for unloading, the possible risks are transferred to the buyer.

In addition, we offer you the possibility to take over the import customs clearance for the consignee when sending your goods outside the European Union.

In our booking process, you can select ‘DAP cleared’ to have the import customs clearance carried out on behalf of the consignee. In this case, you will be charged €55 for groupage shipments and €95 for LTL/FTL shipments and courier services, instead of the consignee.

If you choose DAP uncleared, the consignee will pay the import duty as well as the VAT and customs duties.

Customs duties and taxes are levied in the countries of destination and can therefore not be determined in advance. These import formalities are taken care of by our customs team in the respective country and discussed with the importer and the consignee.

You can find out how to book customs clearance with Cargoboard here.