How do I book customs clearance?

If you want to book customs clearance through Cargoboard for a transport to a non-EU country, there are some settings that are important.

If you select a pickup and/or delivery location in an EU third country when booking with Cargoboard, our platform automatically recognises that this shipment requires customs clearance and provides you with additional settings in the booking process.

Please note: For transports to EU third countries, we currently only offer groupage freight. LTL/FTL or Direct Loads are unfortunately not possible.

What settings do I have to consider for dutiable shipments?

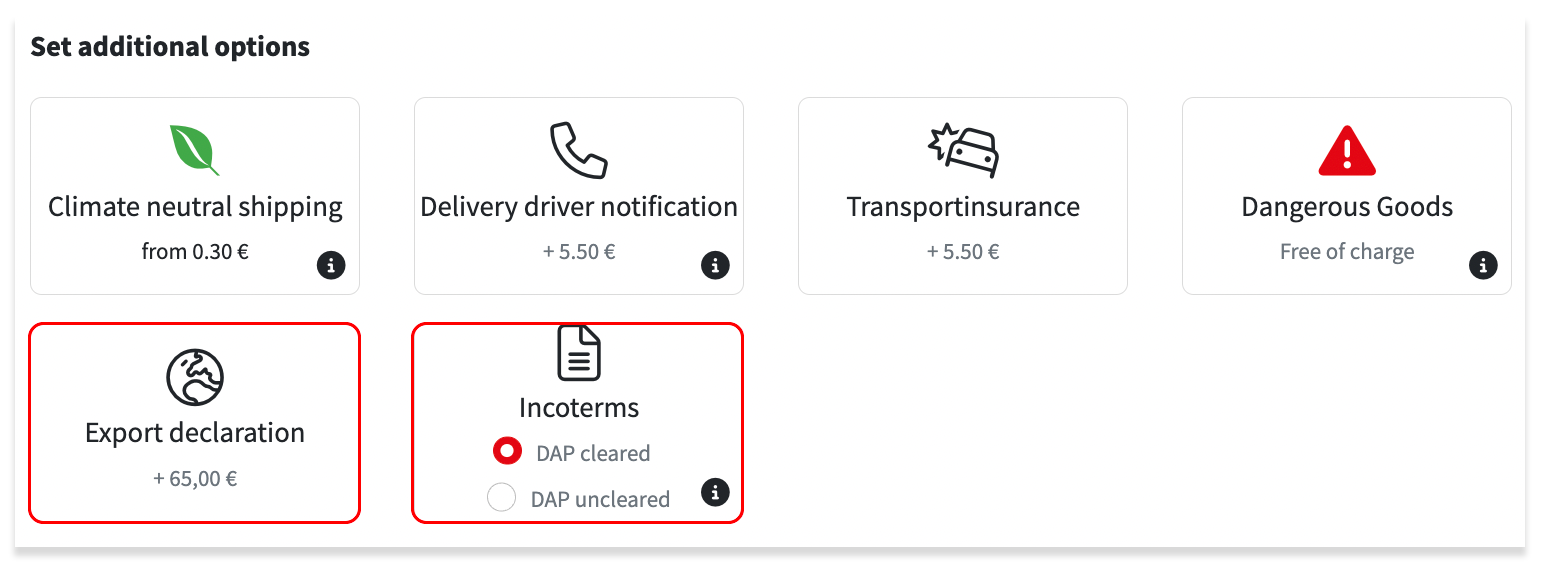

The most important settings for dutiable transports are the export declaration and the selection of the Incoterm.

What do I have to consider when it comes to export declarations?

By selecting the option “export declaration”, Cargoboard will take care of the export declaration and communication with customs for you.

Note: To make the export declaration go as smoothly as possible, we need the following documents:

- Customs-compliant commercial invoice (We will provide you with a sample commercial invoice after the booking process).

- Packing list (net/gross weight & number of packages)

- EORI number

You can find more information on the customs clearance process by clicking here.

If you decide not to book the export declaration, you need to take care of customs clearance yourself.

What do I have to consider regarding the Incoterms?

In the adjacent field you have the option to adjust the Incoterm.

Info: Incoterms stands for International Commercial Terms. These clauses comprise a set of predefined international rules published by the International Chamber of Commerce that define contract terms for international commercial contracts.

Cargoboard only offers transports that comply with the Incoterm DAP.

In the case of DAP - Delivered At Place, the seller bears the costs and risks of transporting the goods to an agreed address. As soon as the goods arrive and are released for unloading, the possible risks are transferred to the buyer.

In addition, we offer you the possibility to take over the import customs clearance for the consignee when sending your goods outside the European Union.

In our booking process, you can select DAP cleared to include the import customs clearance payment of €55 for groupage or €95 for part and full truckloads for the consignee of your shipment.

If you choose DAP uncleared, the consignee will pay the import duty as well as the VAT and customs duties.

If you click on "Continue" after making your selection, a notification window will open with information on when customs clearance is necessary. At this point you must give your consent to the customs clearance process.

How do I complete the booking of a dutiable transport?

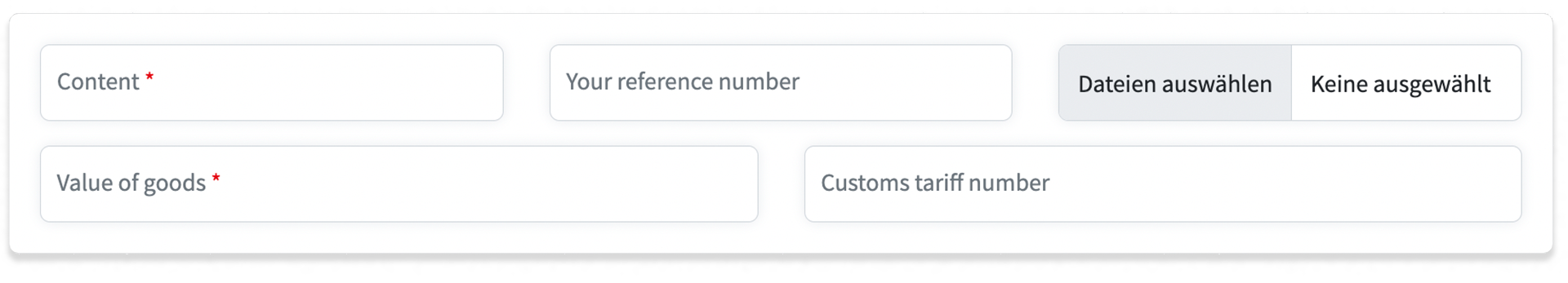

After you have provided the details for collection and delivery, you need to enter the content and value of the goods you are shipping. If you are only shipping one category of goods, you can directly enter the corresponding customs tariff number.

At this point you are capable to upload the documents required for customs clearance.

You can find out which documents we need and what you should be aware of by clicking here.

After you have completed your booking, we will get in touch to discuss the next steps.